The Benefits of Automated Saving: How Cowrywise Helps You Build Wealth

By Ayomide Olatunde • 3 Mins read

|

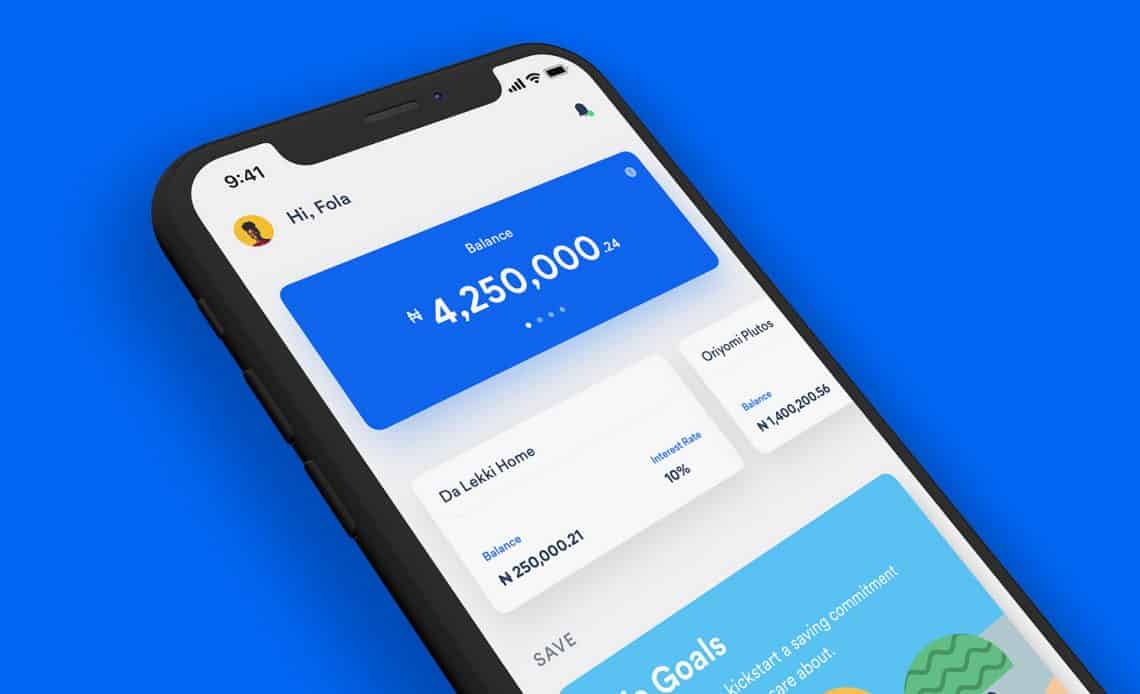

| Source: Cowrywise blog |

Introduction

In today's fast-paced world, saving money can often feel like a daunting task. However, with a fintech solution like Cowrywise, saving has become more accessible and effortless than ever before. In this comprehensive guide, we'll delve into the benefits of automated saving and explore how Cowrywise is revolutionizing the way Nigerians build wealth for their futures.

The Rise of Automated Saving

Traditional saving methods often require discipline and manual effort, making it challenging for many individuals to consistently set aside money for their financial goals. Automated saving, on the other hand, leverages technology to streamline the saving process, allowing users to set up recurring transfers from their bank accounts to their savings or investment accounts automatically.

Effortless Wealth Building with Cowrywise

Cowrywise is at the forefront of the automated saving revolution in Nigeria, offering users a convenient and efficient way to save and invest their money. With Cowrywise, users can easily set up automated transfers from their bank accounts to their Cowrywise savings or investment accounts on a regular basis, such as weekly, bi-weekly, or monthly.

Benefits of Automated Savings

● Consistency and Discipline: Automated saving with Cowrywise ensures consistent contributions to your savings or investment accounts, fostering discipline in your financial habits. By setting up automatic transfers, you remove the temptation to spend impulsively and cultivate a regular savings routine.

● Effortless Accumulation of Wealth: With automated saving, you can effortlessly accumulate wealth over time without having to actively monitor or manage your savings accounts constantly. Cowrywise's seamless automation allows you to grow your wealth gradually, even while you focus on other aspects of your life.

● Financial Goal Achievement: Automated saving with Cowrywise empowers you to work towards your financial goals with greater clarity and confidence. Whether you're saving for a dream vacation, a down payment on a home, or retirement, Cowrywise helps you stay on track by automating your contributions and providing tools to track your progress.

● Customized Saving Plans: Cowrywise offers customizable saving plans tailored to your specific financial objectives and time horizon. Whether you're saving for short-term goals like an emergency fund or long-term goals like retirement, Cowrywise provides flexible options to suit your needs.

● Financial Freedom and Peace of Mind: By automating your saving and investment process with Cowrywise, you can work towards achieving financial freedom and peace of mind. Knowing that you're actively building wealth for your future allows you to focus on enjoying life without the stress of financial uncertainty.

● Accessibility and Convenience: Cowrywise's user-friendly platform makes automated saving and investing accessible to everyone, regardless of their financial knowledge or experience. With just a few clicks, you can set up automated transfers and start building wealth from anywhere, at any time.

● Sustainable Financial Habits: By incorporating automated saving into your financial routine, you develop sustainable saving habits that can last a lifetime. Cowrywise helps you establish a solid foundation for your financial future, setting you on the path to long-term prosperity and security.

In summary, automated saving with Cowrywise offers a multitude of benefits that can help you build wealth, achieve your financial goals, and ultimately attain financial freedom. With its emphasis on consistency, convenience, and customization, Cowrywise empowers you to take control of your finances and create a brighter financial future for yourself and your loved ones.

Innovative Features and Tools

Aside from automated saving, Cowrywise offers a range of innovative features and tools to help users manage their finances effectively. These include:

● Goal-based savings: Set specific financial goals and track your progress over time.

● Investment options: Diversify your portfolio with a range of investment options tailored to your risk tolerance and investment objectives.

● Financial education resources: Access educational content and resources to improve your financial literacy and make informed decisions about your money.

How Cowrywise Works

Setting up automated saving with Cowrywise is simple and straightforward. Users can download the Cowrywise app from the App Store or Google Play Store, create an account, and link their bank accounts to start saving automatically. They can then set their saving goals, choose their preferred frequency and amount for automated transfers, and watch their savings grow effortlessly over time.

Conclusion

In conclusion, automated saving offers numerous benefits for individuals looking to build wealth and achieve their financial goals. With Cowrywise leading the way in Nigeria's fintech landscape, saving has never been easier or more accessible. By leveraging technology to automate the saving process, Cowrywise is empowering Nigerians to take control of their financial futures and build lasting wealth for themselves and their families.

Start your journey to financial freedom today with Cowrywise and experience the transformative power of automated saving!

Comments

Post a Comment